✽ Why

Why Industry Expertise Matters

Every industry operates with different financial rhythms.

We adapt reporting, workflow, and KPIs to your sector.

You receive actionable insights—not generic bookkeeping.

Industries We Serve

Not-for-Profit & Charities

Compliance, transparency, and audit-ready financials.

Non-profits face unique scrutiny from both the CRA and their donors. We specialize in Fund Accounting to ensure every dollar is tracked against its specific restriction. We prepare your T3010 returns, manage specialized payroll needs, and ensure your books are audit-ready at all times. Our goal is to protect your charitable status while giving your board clear, transparent financial reports to support governance and fundraising.

E-commerce & Retail

Navigating sales tax complexity and cross-border margins.

Selling online means dealing with complex sales tax rules (GST/HST/PST/QST) and potentially US nexus issues. We take the headache out of multi-channel accounting. We reconcile your payouts from Shopify, Amazon, and Stripe against your bank deposits to ensure accurate revenue recognition. Beyond compliance, we act as your CFO to analyze your true Cost of Goods Sold (COGS) and shipping margins, helping you understand which products are actually driving profit.

Technology & Startups

SR&ED credits, burn rate management, and investor reporting.

For tech startups, cash is oxygen. We help you extend your runway by meticulously preparing claims for SR&ED tax credits and government grants. We provide fractional CFO services to model your burn rate and prepare sophisticated financial decks for Venture Capital due diligence. Don't let poor accounting structure jeopardize your next fundraising round—we build a scalable financial foundation from Day 1.

Professional Services

Tax planning and wealth retention for professionals.

Whether you are a law firm, a consulting agency, or an engineering practice, your main asset is your time. We optimize your corporate structure to minimize personal tax liability through dividends vs. salary strategies. We manage your Work-In-Progress (WIP) accounting to ensure accurate revenue recognition and help you implement cash flow strategies that smooth out the peaks and valleys of project-based billing.

Food & Beverage

Keep a tight lid on food costs and labor ratios.

In the restaurant business, pennies matter. We provide granular reporting on prime costs—Food, Beverage, and Labor—so you can spot inefficiencies immediately. We handle the intense volume of supplier invoices and manage tip allocation and payroll compliance to keep the CRA away. Our weekly reporting gives you the agility to adjust menu pricing or staffing levels before the month is over.

Healthcare Professionals

Specialized tax strategies for Medical Professional Corporations.

Doctors and dentists have unique opportunities for tax deferral and investment within their Professional Corporations. We specialize in tax planning for healthcare providers, helping you decide how much to draw from your corporation to optimize your personal tax bracket. From setting up Individual Pension Plans (IPPs) to managing holding companies for your investments, we ensure your hard work translates into long-term wealth.

Real Estate Holdings

Asset protection and tax-efficient portfolio growth.

Real estate accounting requires a long-term view. We structure your holdings to separate liability and optimize capital gains tax. Whether you are flipping properties, holding long-term rentals, or managing a REIT, we handle the bookkeeping for each door. We advise on deductions for repairs vs. capital improvements and ensure your financing costs are properly expensed to maximize your net rental income.

International Subsidiaries

Local compliance for global companies entering Canada.

Expanding into Canada offers great opportunities but comes with strict CRA compliance rules. We act as the local finance team for foreign parent companies. We handle Transfer Pricing documentation, GST/HST registration for non-residents, and monthly reporting packages converted to your HQ’s currency and GAAP standards. We bridge the gap between Canadian tax law and your global reporting requirements.

What You Can Expect From Us

Accurate reporting, always on time.

We deliver structured financial reporting built on precision, consistency, and clarity. Every statement is prepared to support real decision-making — not just compliance. You get timely reports, standardized across your organization, so leadership can operate with complete visibility.

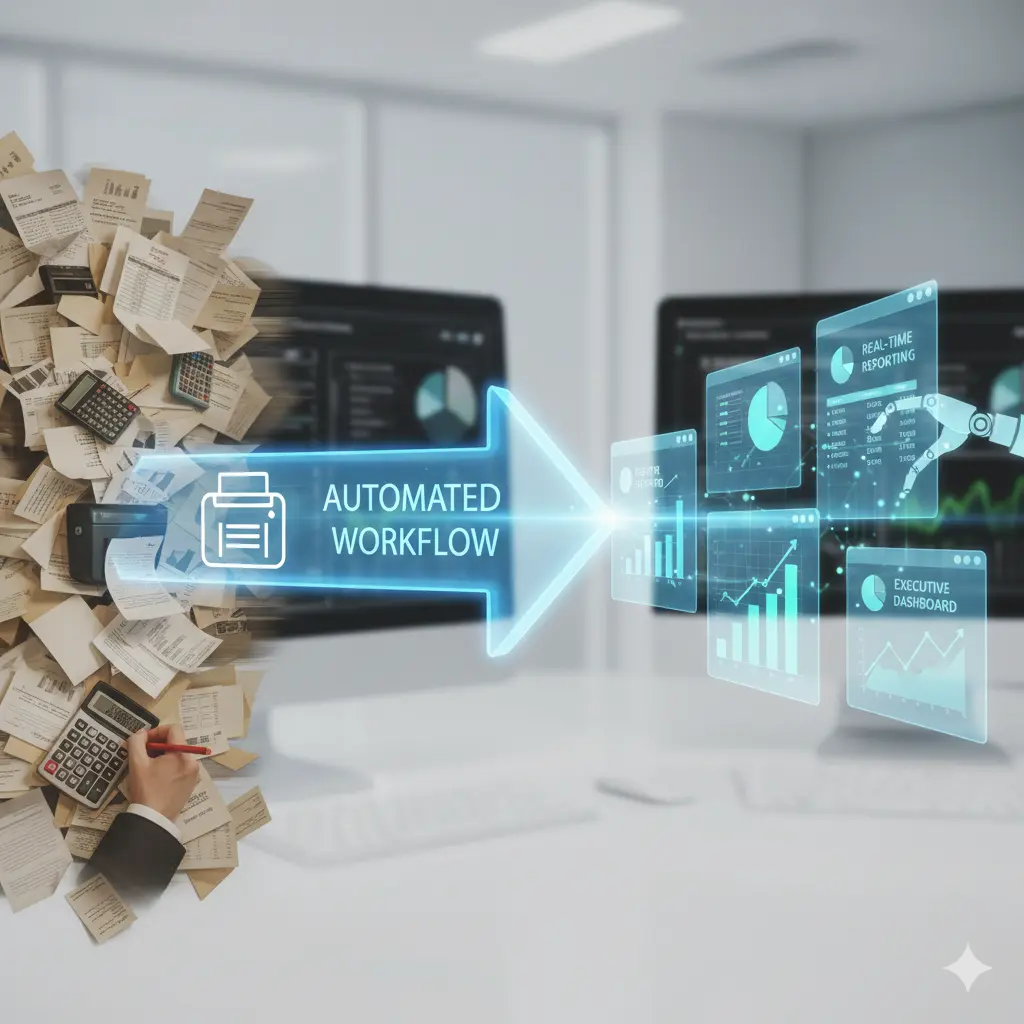

Automation that removes manual work.

We streamline workflows by integrating accounting automation, approval routing, and intelligent data capture. Manual tasks disappear, errors drop, and your team focuses on what actually creates value. The result: faster operations and cleaner books, every month.

CFO-level guidance to improve margins and scale safely.

Beyond bookkeeping, we provide strategic financial insight. From margin optimization to forecasting, cash-flow planning, and KPI design, we help you understand where the business is going — and how to steer it. You get the financial discipline of a CFO, tailored to your industry.

Let's Connect

Get in touch with your customers to provide them with better service. You can modify the form fields to gather more precise information.